In the hustle to secure investments, there’s a tendency to rush into commitments without proper diligence.

Traditionally, investors seek out evidence of “traction” before opening their wallets. This preference for proof of progress might baffle entrepreneurs eager to dive back into the trenches of their business operations. However, understanding this investor mindset not only makes sense but also guides how you should cultivate relationships with potential financiers. Remember, tying the knot means you’re both in it for the long haul.

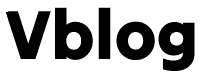

At our initial meeting, you represent a solitary data point to me a dot. Without historical data, assessing your past performance or predicting your future trajectory is challenging. Hence, making an investment decision at this stage is fraught with uncertainty.

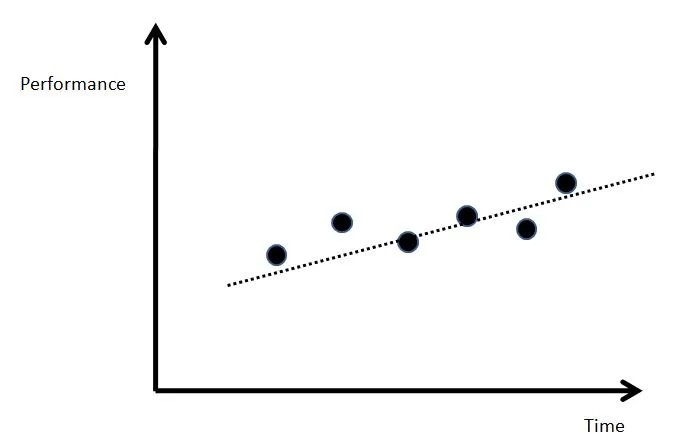

Therefore, my advice to entrepreneurs is this: Engage with prospective investors well before you need to. Explain that while you’re not currently fundraising, you intend to in the near future. Express your interest in giving them a preliminary look something all investors covet. In these early discussions, set realistic expectations by sharing where you’re at in your journey, be it still in the product development phase or further along.

Crucially, outline what you aim to accomplish by your next interaction. When that time comes, providing an update on significant milestones or advancements will demonstrate your progress. Maintain these interactions brief and convenient, like a quick coffee, and respect their time as promised.

I’ve delved deeper into these ideas in previous posts on investment criteria and managing VC relationships. Rather than dedicating a block of time annually for fundraising, incorporate it as a regular task. After all, managing finances is a critical component of any business, startup or established.

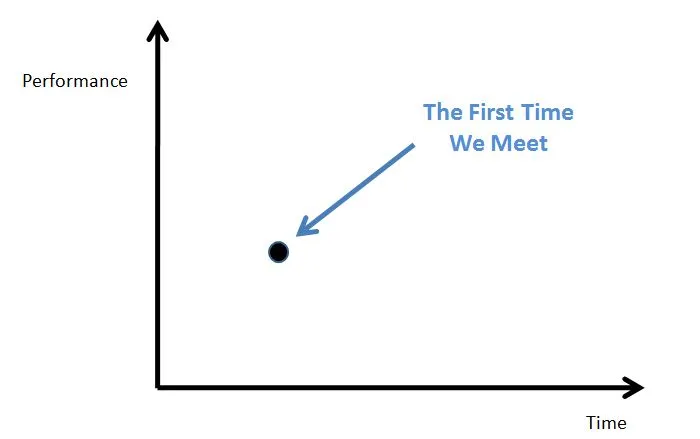

Over time, a pattern of progress emerges from these meetings. Performance, in my book, is a broad term encompassing various forms of progress, whether it’s product development, customer engagement, team expansion, or media attention. It’s about the perception of forward motion.

This process isn’t about proving overnight success but rather about fostering a relationship and allowing the investor to understand your thought process and resilience. For instance, I decided to invest in Ad.ly after observing Sean Rad’s performance at Orgoo for a year. Although Orgoo wasn’t a success, Sean’s potential was evident.

Similarly, my interactions with Evan Rifkin spanned over two years before investing in Burstly, even before the company was founded. These meetings affirmed Evan’s entrepreneurial talent and ensured a mutual respect.

Recently, in New York, I encountered a promising company poised for disruption. Despite the investment frenzy around it, my decision to hold off was due to a lack of sufficient data points. This situation underscores the rapid pace of the current market, where investments are often made based on limited information.

Here’s my takeaway:

Investors: The market’s velocity leads to decisions based on scant data, by angels and VCs alike. Investing in mere dots can lead to misguided expectations and contribute to market bubbles, which have their upsides for entrepreneurs but can also create turmoil.

Lines vs. Dots: A conversation on HackerNews highlighted an important perspective: what’s a dot to one investor could be a line to another who’s engaged earlier. This emphasizes the value of early and continuous engagement with entrepreneurs to observe their trajectory.

Entrepreneurs: Quick funding rounds might feel like a win, but remember, investor relationships are enduring. While VCs and seasoned angels may take a measured approach, less experienced investors can become burdensome, potentially complicating future fundraising efforts.